Fantastic Info About How To Avoid Wire Transfer Fees

First, assess if you genuinely require the funds to be wired.

How to avoid wire transfer fees. There are ways to reduce wire transfer fees or avoid them altogether if you know how. Otherwise, the best way to avoid this fee is just to hang onto your debit card. Contractually transfer the cost of wire.

(if you tend to lose things, this is easier said than done!) it could be helpful to buy a wallet or purse to. You may be able to avoid wire transfer fees by doing business with a financial institution that waives them for certain customers or doesn’t charge them at all. If you need to move funds within the united states, your bank may have options that do.

Wed, 06 jul 2022 07:00:00 gmt. What are wire transfer fees & how to avoid them read more » content pnc routing number & wire transfer summary compare u s. $0 transfer fee* when you send money online through october 31st.

Fees, rates and transfer time it is a bit more complicated when it comes to foreign wire transfers, also known as remittance transfers. & international wire transfer fees us bank international wire transfer: For example, pnc bank waives its $30 outbound and $15.

For example, pnc bank waives its $30 outbound. How to avoid wire transfer fees select a bank or other financial institution that may reduce or waive wire transfer fees or offer lower costs than. Another way to snag lower or waived wire transfer fees (among other fees) is to open a more “exclusive” checking account.

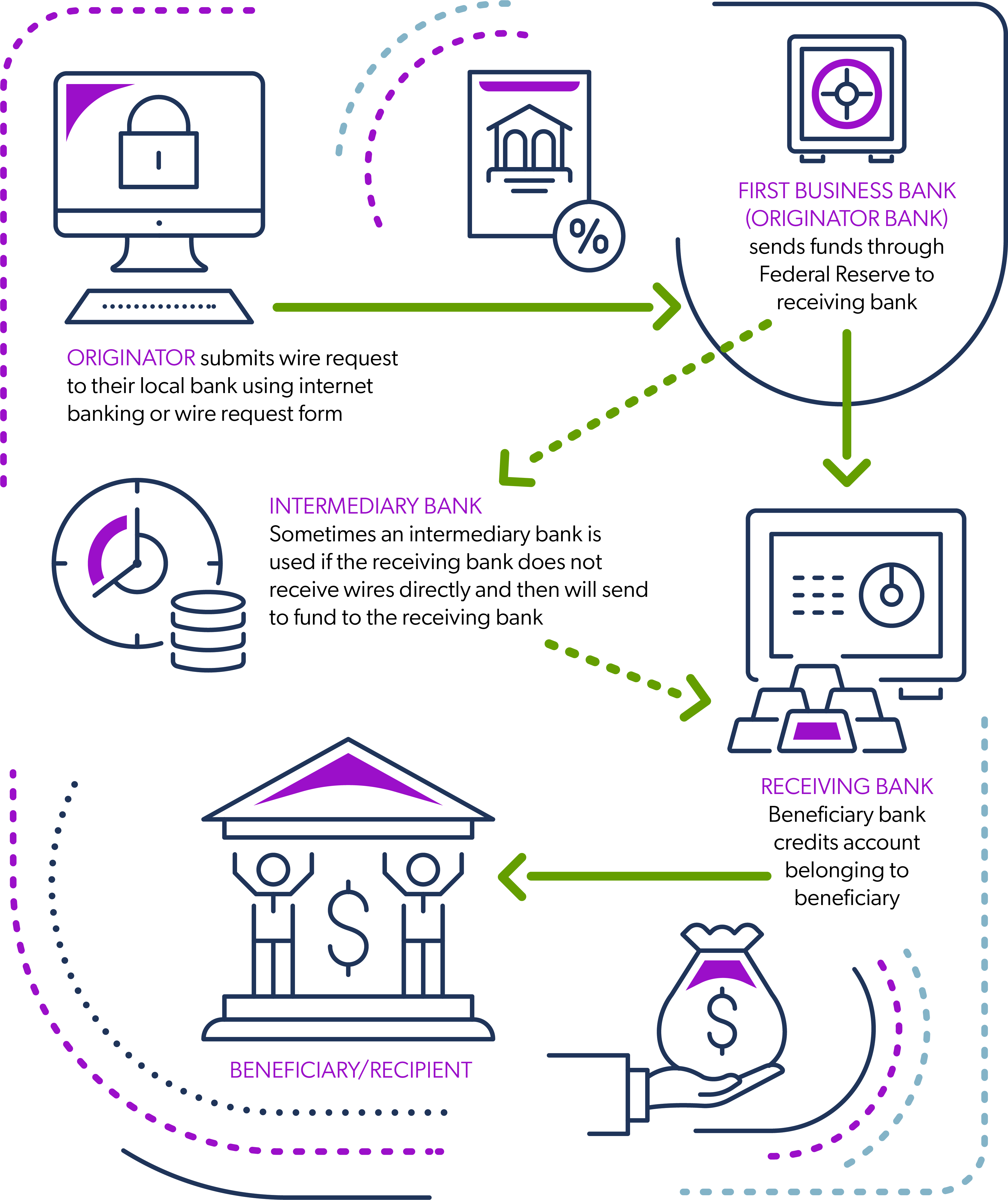

How to get huntington bank wire transfer fees waived with donotpay. Some banks do not charge incoming wire transfer fees, though there may be intermediary banks or credit unions that are involved in the transfer process — and they might. If you need to wire money often, you’ll want to pick a bank with the lowest possible fees.

/wiretransfer-FINAL-f795d71916014a69bc79fd27dfe62940.png)

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/xlmedia/7JBMWZ3XSFGB5P3AO65YSQVIRQ.jpg)