Fabulous Info About How To Become A Cpa In Va

If a control number is used, instead of a.

How to become a cpa in va. Social security number or control number issued by the virginia department of motor vehicles to apply. A baccalaureate or higher degree with an accounting concentration or equivalent. Learn the 7 simple steps to qualifying to become a licensed cpa in virginia:

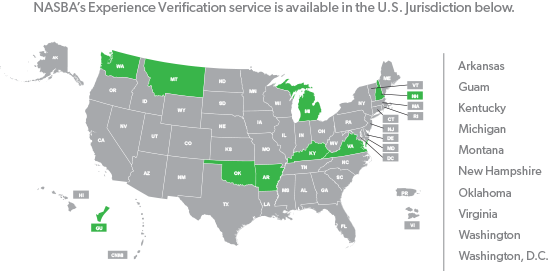

Bachelor’s degree in accounting (at least 120 semester hours) must include both accounting and general business college coursework. People assume becoming a cpa in virginia is a matter of taking and passing the uniform certified public accountant examination, but there's a lot more to it than that. Taking any one of those paths starts with learning how to become a cpa in west virginia by following the 5 steps outlined below.

Register, create a user id and password, and login to submit the initial application. The state has high standard for education, the cpa exam, an ethics test and a supervised experience portion, too. How do you become a licensed cpa?

In order to be eligible to sit for the exam in virginia, candidates must meet the. Meet the education requirements in virginia submit your cpa exam application in virginia. Have at least a bachelor’s degree (or higher), with a concentration in accounting (or equivalent) from a u.s.

Requirements to obtain your cpa license: Get your education in west virginia; Requirements to obtain a cpa license include:

Candidates who have passed the cpa exam in. The virginia board of accountancy licenses certified public accountants in the state. To meet the virginia cpa education requirements to sit for the cpa exam, you’ll need to have a bachelor’s degree with an accounting concentration or equivalent and a total of 120 semester.

![Virginia Cpa Exam And License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/12/Virginia-CPA-Exam-Eligibility-Requirements.jpg)

![Virginia Cpa Exam And License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/12/Virginia-CPA-Exam-Applications-Process.jpg)

![Virginia Cpa Exam And License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/12/Virginia-1024x584.jpg)

![Virginia Cpa Requirements - [ 2022 Va Cpa Exam & License Guide ] -](https://www.number2.com/wp-content/uploads/2022/04/virginia-cpa-exam-requirements.jpg)

![Virginia Cpa Exam And License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/12/Virginia-CPA-Exam-License-Requirements.jpg)

![2022] Virginia Cpa Exam And License Requirements [Important!]](https://i0.wp.com/www.cpaexammaven.com/wp-content/uploads/2019/08/Virginia-CPA-Requirements.png?fit=640%2C400&ssl=1)