Brilliant Strategies Of Tips About How To Check Out Charities

Charities and other nonprofit organizations there is.

How to check out charities. A party, committee, association, fund or other organization organized and operated primarily for the purpose of directly or indirectly accepting contributions or making. You also can do your own research into how a charity allocates its money by checking its irs form 990,. Leave out the and and and &.

Be wary if an organization is spending more than 25% on overhead. Ask about the type of progress the charity has made toward its goals. Directory of charities and nonprofit organizations guidestar is the most complete source of information about u.s.

How do i check on a charitable organization? Once you have chosen 2 to 3 charities, contact them and ask questions. Charitywatch does not merely repeat what a charity reports using simplistic or automated formulas.

For years it has received the annual tax forms that charities file with the irs (called 990 reports). We dive deep to let you know how efficiently a charity will use your. You can search pub.78 data (for 501(c)(3) or other organizations eligible to receive deductible charitable contributions) or the exempt organizations business master file extract (for other.

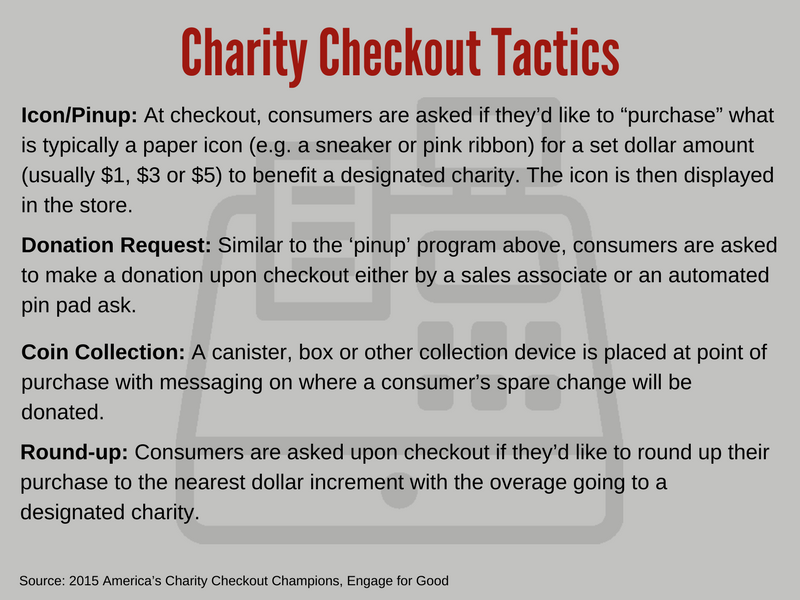

You can also view charities by: 7 easy ways to check out charities. Here are some tips for ensuring that:

The easiest way to research national charities is with the three major charity watchdogs: Check bbb wise giving alliance. Enter one to three words you are sure of.