Simple Info About How To Lower The Interest Rate On Your Credit Card

18 hours agoone way to lower your interest rate is to make a balance transfer to a credit card with another bank.

How to lower the interest rate on your credit card. Ad turn to the nerds to find 2022's best low interest credit cards. This is the number you’ll want to call. On the back of each credit card there’s a customer service number.

Easily compare 2022's best debt consolidation services. Learn more & apply today. To calculate this daily interest rate yourself, divide your apr by.

Find your next favorite low interest card with our trusted, comprehensive reviews. The federal reserve announced its fifth consecutive interest rate hike on wednesday, bumping up the target federal funds rate by 0.75% to reach a range of 3% to 3.25%. Today’s rate of 6.02% brings the.

Ask your card issuer for a reduction. Contact your credit card issuer and explain why you would like an interest rate. How to lower your credit card interest rate.

If you’re looking to lower the apr on your credit card, you may have seen articles that tell you to pick up the phone and simply ask your credit card issuer for a lower rate. Once you’ve researched the competition and worked to improve your chances of getting approved for a lower interest rate, it’s time to begin. Try again in a few months, because the company may be willing to offer an even lower interest rate.

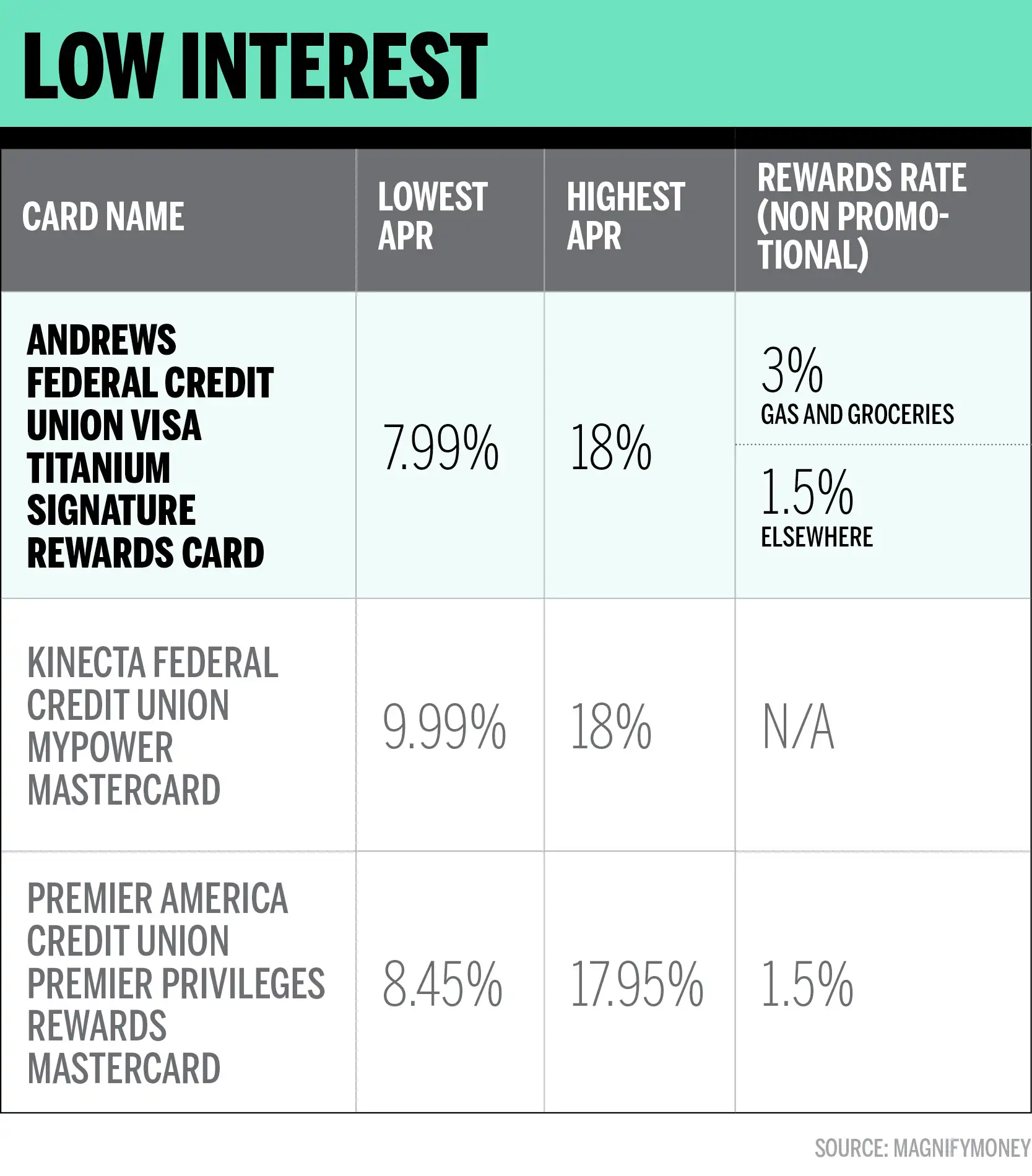

Ad browse these card categories: What rate hikes cost you. The two main ways to lower credit card interest rates are to negotiate with the credit card company or to consolidate credit card debt into one lump sum with a lower.